Mastering Your Startup's Cap Table: A Step-by-Step Practical Guide to build a cap table from Seed to Exit - Part 1

You’ve probably read tons of articles about the different rounds of VC funding and all the associated terms, but how often do you come across something that really breaks down the numbers? Ever wondered how to keep track of your startup’s equity as you grow? Dive into our hands-on guide to cap tables, where I break down everything from your first seed round to that exciting exit moment. Let’s get your cap table game on point!

This guide provides a hands-on example of building a cap table from start to exit. Managing a cap table is crucial for startup financing but can get complex. This guide provides a practical example of building a cap table from start to exit. I will explore the impact of various financial instruments and terms through different investment rounds and exit scenarios. Whether you’re new to cap tables or looking for deeper insights, this guide offers solid foundational knowledge with comprehensive examples. By walking you through various scenarios and terms with comprehensive examples and visual aids, I offer a solid foundation for managing equity financing in startups. While real-world cap tables can be intricate, this primer ensures fair ownership and proceeds distribution, helping you maintain investor confidence and support your startup’s long-term growth.Let’s get your cap table game on point!

Cap tables may seem straightforward at first, but they can quickly become complex when you factor in different terms such as discounts, warrants, valuation caps, liquidation preferences, and participation rights. In my previous post ( Link in medium, Link in Linkedln), I briefly explained these terminologies and the factors to consider. In this post, I’ll provide a detailed, practical case example to show how these various terms can affect the cap table.

I’ve divided my analysis into multiple boxes, each walking you through different scenarios to illustrate the impact of these terms.

Initial Cap Table Setup

Let’s begin by setting up the initial cap table when the co-founders decide to start the company. At this stage, the cap table is relatively simple, showing the shares allocated to each co-founder and their fully diluted ownership percentages. This foundational setup will evolve as the company raises funds through various investment rounds.

Box 1: Seed Round with Convertible Notes and Option Pool

In this section, I will describe a seed round featuring unpriced financing through convertible notes and the establishment of an employee option pool. Convertible notes are flexible financing instruments often used by startups instead of traditional priced equity rounds. They enable investors to provide capital without the need to determine the company’s valuation immediately.

Convertible Notes and Their Terms

Convertible notes are essentially debt instruments that convert into equity at a future financing round, usually the Series A round. These notes come with various terms to compensate investors for the risk of investing early:

Valuation Discount: Allows investors to convert their notes into equity at a lower price compared to future investors. For example, a 20% discount means that the conversion price will be 80% of the price paid by new investors in the next round. This discount compensates investors for the early-stage risk they undertake.

Valuation Cap: Sets a maximum company valuation at which the notes can convert into equity, protecting noteholders if the company raises its next round at a higher valuation. For instance, if the valuation cap is £18 million, and the company’s next round values it at £20 million, the notes will convert as if the company’s valuation were £18 million, ensuring the early investors get a better deal.

Interest Rate: Convertible notes accrue interest, which is added to the principal amount. This interest compensates investors for the time the note is held and increases the number of shares issued upon conversion.

Maturity Date: As debt, convertible notes have a maturity date by which they must be repaid or converted into equity. If the company shuts down or goes bankrupt before conversion, the notes must be repaid first, giving noteholders a senior position over equity holders.

Employee Option Pool

An employee option pool is created to set aside equity for future hires, which dilutes the ownership percentage of the co-founders but is essential for attracting and retaining talent. Employees receiving options in the seed round will get an exercise price set during the next priced round, typically the Series A.

Case Example

In this scenario, two firms, Firm 1 and Firm 2, decide to invest in the startup through convertible notes:

Firm 1: Invests £1 million with a conversion discount of 20%. This means Firm 1 will convert its notes into equity at 80% of the price paid by new investors in the Series A round.

Firm 2: Invests £1 million with a valuation cap of £18 million. This ensures that if the company is valued higher than £18 million in the next round, Firm 2 will convert its notes at the capped valuation, securing a better conversion rate.

Both firms opt for a 1x liquidation preference, meaning they will get their initial investment back in the event of liquidation.

These terms illustrate how convertible notes can be tailored to balance the needs and risks of both the startup and the investors. By incorporating a valuation discount, valuation cap, and interest, the notes provide early investors with significant protections and potential upside, while the option pool helps the company attract the talent necessary for growth. This structured approach ensures that all parties are compensated and incentivized, laying a strong foundation for future financing rounds and the company’s growth trajectory.

Box 2: Series A Investment Round

In Box 2, we explore the Series A investment round, highlighting the complexities introduced by the conversion of convertible notes from the seed round. This round sees new investors coming in with specific terms and preferences, adding layers of intricacy to the cap table.

Series A Investment Details

During the Series A round:

Firm 3 and Firm 4 each invest £5 million.

Liquidation preference: 1x.

Pre-money valuation: £25 million.

Post-money valuation: £35 million.

Initial ownership: 14.2% each.

Convertible Note Holders and Their Conversion

The complexity arises when the convertible note holders from the seed round, Firm 1 and Firm 2, decide to convert their notes into equity. The initial £1 million investments from these firms have accrued interest, increasing the principal to £1.22 million each. This increased principal affects the number of shares Firm 1 and Firm 2 receive during the Series A round.

Series A Price Per Share

To determine the Series A price per share, we divide the pre-money valuation by the pre-money share count. In this case, the calculation is £25 million divided by 1,111,111 shares, resulting in a Series A price of £22.50 per share. However, the share prices for seed investors are adjusted based on the terms of their convertible notes, either through a discount or a valuation cap.

Impact on Seed Investors’ Share Prices

Firm 1: With a 20% discount, Firm 1 receives Series A shares at a reduced price of £18.00 per share.

Firm 2: Subject to a valuation cap of £18 million, Firm 2 receives shares at a price of £16.20 per share.

These adjustments lead to an increase in the number of shares allocated to Firm 1 and Firm 2, thereby diluting the ownership percentages of the Series A investors.

Final Ownership Percentages

The final ownership percentages are influenced by these conversions. Series A investors, who initially expected a 14.2% stake each, see their ownership reduced to 12.52% each due to the increased share count from the discounted and capped conversions of the seed round investors. As a result, the final value for the Series A investors is £4,380,573 for their £5 million investment (marked in red in the value in £ column in post-capitalisation series A round).

Post-Money Valuation

The post-money valuation is higher due to the discount and valuation cap applied to the seed round, resulting in lower ownership percentages for Series A investors. This scenario illustrates the impact of convertible note terms on the cap table and highlights the importance of understanding the nuances of such financial instruments.

Box 3: Adjusting for post-money valuation to Reduce Dilution

In Box 3, I explain how to adjust the effective pre-money valuation to reduce the dilution impact on Series A investors. By using the adjusted money invested , you can ensure a fairer distribution of ownership among investors while maintaining the integrity of the cap table.

Adjusted Post-Money Valuation

The adjusted post-money valuation is calculated by summing the pre-money valuation, the investment from Series A investors, and the convertible principal from the seed round. This adjusted figure is crucial for determining the true valuation and subsequent share distribution, highlighted in yellow in the cap table.

Calculation Steps

Effective Pre-Money Valuation:

The effective pre-money valuation is derived by deducting the option pool, Series A investment, and the convertible notes (with discounts and valuation caps) from the adjusted post-money valuation. This ensures a more accurate reflection of the company’s value before new investments are added.

Effective Share Prices:

Series A Share Price: Calculated by dividing the pre-money valuation by the number of shares from the previous round. In this case, the effective Series A share price is £19.68.

Seed Investors’ Share Prices: Adjusted for discounts and valuation caps, resulting in prices of £15.75 and £18.00 for Firm 1 and Firm 2, respectively.

Option Pool Adjustment:

New options are calculated to maintain the desired percentage of total shares. This step is crucial for ensuring that the employee option pool remains attractive to potential hires without overly diluting existing investors.

Impact on Ownership

By using the dollar invested adjusted method, the ownership percentages for Series A investors increase from 12.52% (without adjustment) to 13.8% (adjusted). This results in a final value of slightly over £5 million (£5,008,386) for Series A investors. This adjustment helps to balance the interests of early and later-stage investors, ensuring that Series A investors receive a fairer share of the company’s equity.

Negotiations with Seed Investors

Negotiating these adjustments with seed round investors can be challenging. Seed investors may be reluctant to lose stakes to accommodate Series A investors’ demands. However, presenting a clear and detailed cap table, along with the potential benefits of a more balanced ownership structure, can help facilitate these discussions.

Mitigating Downsides of Convertible Notes

While convertible notes offer simplicity and flexibility, they can lead to lower investor returns compared to traditional priced equity rounds. The delayed conversion and potential for complex terms can result in lower ownership percentages and returns for investors. To mitigate these downsides, companies should:

Limit the dollar amount raised through unpriced rounds.

Create cap tables at different valuations to illustrate the impact on investors.

Box 4: Down-Round Scenario and Anti-Dilution Protections

In Box 4, we address a down-round scenario during the Series B investment round. A down-round occurs when the company’s valuation decreases from the previous round, triggering anti-dilution provisions to protect existing investors from significant ownership dilution.

Series B Investment Details

For the Series B round:

Pre-money valuation: £20 million.

Series B share price: £10.89 per share.

Investment by Firm 5 and Firm 6: £5 million each, with a 1x liquidation preference.

Anti-Dilution Provisions

Anti-dilution provisions are designed to protect venture capitalists (VCs) who own preferred stock from significant ownership dilution during down-rounds. There are three main types of anti-dilution provisions:

Full-Ratchet Anti-Dilution: The most aggressive method, allowing existing investors to convert their preferred shares to common shares at the new lower price, resulting in a significant increase in their share count and ownership percentage.

Broad-Based Weighted Average Anti-Dilution: Less aggressive than full ratchet, this method adjusts the conversion price based on the average share price, including all fully diluted shares, resulting in a moderate increase in the share count for VCs.

Narrow-Based Weighted Average Anti-Dilution: Excludes options and warrants from the calculation, offering a slight advantage to VCs compared to the broad-based method.

In this cap table exercise, broad-based weighted average anti-dilution is applied.

Impact on Share Prices and Ownership

With broad-based anti-dilution applied, the adjusted share prices and additional shares allocated are as follows:

Series A Investors:

New share price: £16.75.

Additional shares obtained: 596,950.

Seed Investors:

Firm 1:

New share price: £14.13.

Additional shares obtained: 86,339.

Firm 2:

New share price: £15.63.

Additional shares obtained: 78,069.

Impact on Co-Founders and Employees

The co-founders and employees bear the brunt of the dilution:

Co-Founders:

Ownership reduced from 54.4% to 28.4%.

Employees:

Ownership reduced from 10% to 5.2%.

Box 5: Series C Investment Round with participating preference and participating cap

In Box 5, I delve into the Series C investment round, which introduces more substantial investments and more complex terms to the cap table. This round sees significant participation from both new and existing investors, with provisions that heavily favour investor protections.

Series C Investment Details

New Investments:

Firm 7: Invests £25 million.

Firm 8: Invests £25 million.

Existing Investments:

Firm 5: Invests an additional £5 million.

Firm 6: Invests an additional £5 million.

Post-money valuation: £310 million.

Liquidation and Participating Preferences

Liquidation Preference: Both Firm 7 and Firm 8 opted for a 2x liquidation preference.

Participating Preferred Stock: This preference is capped at 3x their investment, meaning investors can receive up to three times their initial investment upon liquidation.

Participating preferred stock allows investors to receive their liquidation preference, which in this case is 2x their initial investment, and then also participate in the remaining proceeds as if they had converted their preferred shares into common shares. This structure provides significant downside protection while also offering substantial upside participation, heavily favouring investors.

Impact on Cap Table and Future Funding Rounds

While these terms offer considerable protection to investors, they can skew the deal in favour of the investors and complicate future funding rounds. Future investors may demand similar or even more favourable terms, setting a precedent that can be difficult to manage

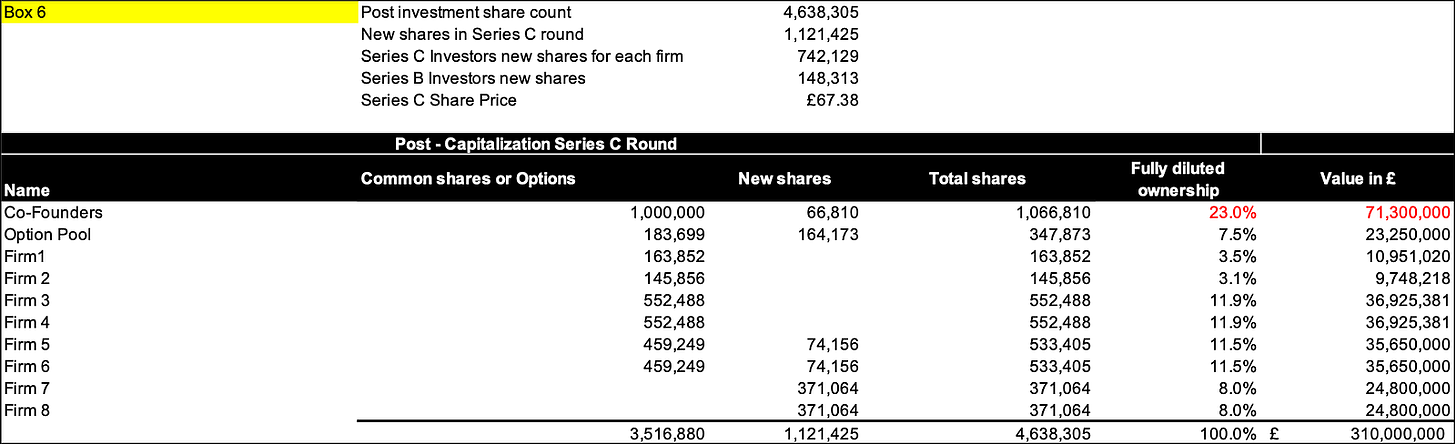

Box 6: Post-Capitalization of Series C Round

In Box 6, I analyse the post-capitalization structure following the Series C investment round. To maintain the motivation and engagement of the co-founders and employees, their ownership stakes are carefully adjusted. This ensures that key personnel remain incentivized as the company continues to grow.

Box 6: Post-Capitalization of Series C Round

Adjusted Ownership Stakes

To reduce the dilution impact on the co-founders and employees:

Co-founders: Ownership stake is set to 23%.

Employees: Ownership stake is set to 7.5%.

Issuance of New Shares

To achieve these adjusted ownership stakes, the following new shares are issued:

Series C Investors:

New shares issued: 1,121,425.

Share price: £67.38.

Series B Investors:

New shares issued: 148,313.

Share price: £67.38.

Co-founders:

New shares issued: 66,810.

Employees:

New shares issued: 164,173.

Summary

Adjusted Ownership Stakes:

Co-founders: 23%.

Employees: 7.5%.

Issuance of New Shares:

Series C Investors: 1,121,425 shares at £67.38.

Series B Investors: 148,313 shares at £67.38.

Co-founders: 66,810 shares.

Employees: 164,173 shares.